Building a Quantitative Trading System

How I'm building a system that scrapes data, finds patterns, and trades automatically.

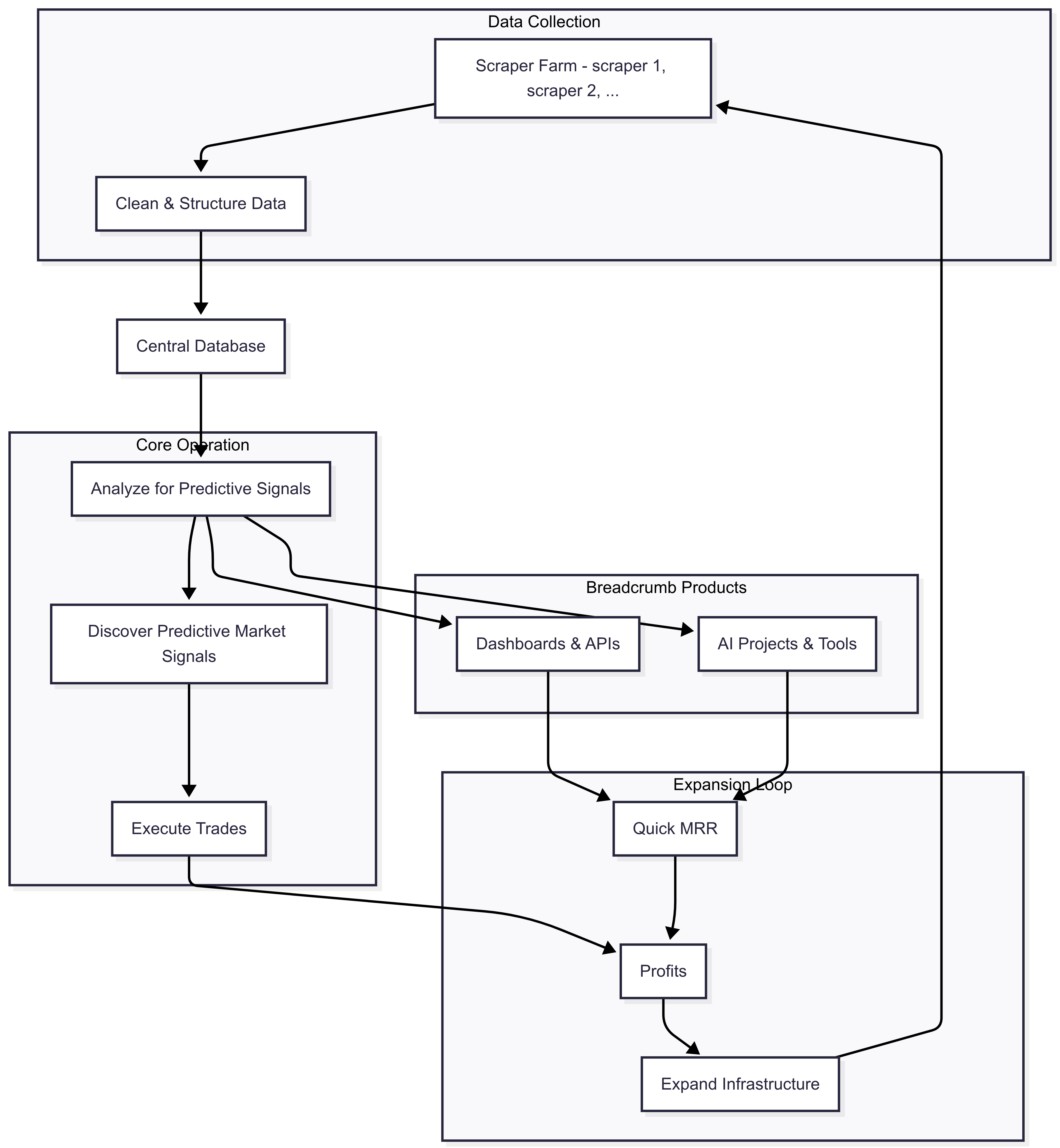

Here's the blueprint I use. It's essentially a self-feeding loop: collect data, find alpha, backtest, build tools from data, add profits to trading machine.

The process is pretty simple:

-

Collect Data

I scrape social media, news, stock prices, timeseries, etc. - anything that might move markets. Goal is to process 1TB daily. -

Find Alpha

I look for signals in the data that predict market moves. -

Backtest

I use those signals to backtest strategies. If they prove useful, I use them. -

Sell Tools

I sell datasets, insights, and tools that arise from the data. -

Scale Up

I reinvest profits to get more data and better models.

The whole thing runs in a circle - profits fund more data collection, which leads to better alpha, which leads to more profits.

System Blueprint:

`

`